The Influence of Data Brokers on Consumer Credit Scores and Financial …

페이지 정보

작성자 Ward Walck 작성일24-09-24 06:17 조회62회 댓글0건관련링크

본문

The world of personal finance is complex and multifaceted. Various entities play a crucial role behind the scenes. These players influence how individuals are perceived in the financial landscape. Often, their activities remain obscure to the average person. This lack of transparency can lead to confusion and skydancefarms.com misconceptions.

Financial assessments are not solely determined by a single entity. Instead, a network of organizations gathers and analyzes vast amounts of information. They sift through records, categorize behaviors, and profile individuals. This intricate web can significantly shape an individual's journey in acquiring loans or credit. Each piece of information contributes to a broader picture.

Moreover, the methods used to gather and interpret this information can vary widely. Consumers may feel overwhelmed by the sheer volume of factors at play. Affected by numerous unseen influences, individuals often wonder how their financial standing was determined. It's a puzzle with many pieces, and not all of them are visible.

As these intermediaries compile profiles, they hold a wealth of information that can elevate or hinder opportunities. The balance of power lies in their hands, creating a situation where individuals often lack control over their own narrative. Understanding the nuances of this system can empower individuals, allowing them to navigate the financial maze with greater awareness.

Understanding Data Brokers' Role

The intricate web of information exchange plays a crucial role in financial assessments. Various entities operate behind the scenes, gathering and analyzing vast amounts of personal information. Their activities are essential for many aspects of the financial system, especially in evaluating individual profiles. However, the mechanisms of this information collection can often seem obscure.

Many organizations utilize extensive databases to compile individual records. These records encompass everything from spending habits to public records. By amalgamating this information, they create detailed profiles. Such profiles offer insights into a person’s financial behavior and reliability.

For instance, a lender might rely on these compiled insights to make informed decisions. A single data point can influence an individual's chances of obtaining a loan or a credit card. This interconnectedness signifies the importance of accuracy and comprehensiveness in the information collected.

Understanding these roles illuminates the broader landscape of financial evaluations. It’s essential to recognize that these entities operate within a vast network, sharing information with various stakeholders, including financial institutions. By providing essential insights into an individual's financial behavior, they facilitate lending decisions, often without direct interaction with the consumer. The data extracted can profoundly influence approval rates and interest terms, underscoring the importance of transparency and accuracy in the consumer profiles they create.

In addition, it’s vital to consider the ethical implications of such practices. As organizations collect more personal data, the line between necessary information and invasion of privacy becomes increasingly blurred. The complexity of these roles highlights both the necessity and the potential for misuse of the information involved.

How Credit Scores Are Calculated

Understanding the intricacies of numerical assessments can often feel overwhelming. These evaluations significantly influence financial opportunities. They determine loan approvals, interest rates, and even rental agreements. The methodologies behind these figures are based on various factors that, when combined, create a comprehensive picture of an individual's financial behavior.

The primary component is payment history. Timely repayments signal reliability, while late or missed payments can have detrimental effects. Next comes the level of debt. High balances in relation to credit limits may indicate over-extension. This perception can lead to reduced trust from lenders. Another crucial aspect is the length of credit history; longer relationships with financial institutions can bolster confidence.

Types of credit utilized also play a role. A mix of installment loans, revolving credit, and mortgages demonstrates versatility. Such a variety can enhance the overall assessment. Lastly, recent inquiries for new credit can reveal a pattern of financial behavior. Frequent requests might suggest possible financial distress or irresponsible management.

Every element intertwines, creating a nuanced narrative of one’s financial habits. Therefore, maintaining healthy practices across these categories is essential for building a strong financial profile.

Impact of Data Accuracy on Scores

In today's financial landscape, the precision of information plays a crucial role in shaping an individual's financial profile. Reliable details can pave the way for favorable outcomes, while inaccuracies can lead to severe consequences. Each piece of information carries weight, influencing decisions made by institutions that assess financial health.

When it comes to assessments, lenders depend heavily on the provided details. A single erroneous entry can skew an evaluation drastically, leading to unfavorable terms or outright rejections. Moreover, consumers often find themselves in a challenging position, as they may not even realize that incorrect information exists in their reports.

Understanding the nuances of how these evaluations work can be empowering. For instance, even a minor mistake–like a misspelled name or incorrect payment history–can detrimentally affect one’s standing. This is not merely about numbers; it's about trust and reliability in financial dealings.

Ensuring that records are accurate requires diligence. Consumers must actively engage in monitoring their profiles. By regularly checking for discrepancies, individuals can take charge of their financial narrative and rectify any issues promptly. This proactive approach fosters a more favorable impression among lending institutions.

Furthermore, the stakes are high. An inaccurate record could mean higher interest rates or limited access to loans. Consequently, the responsibility falls on both individuals and the responsible entities to maintain accuracy. Institutions, too, must ensure that their information systems are robust and reliable, enabling fair assessments of an individual’s financial behavior.

In summary, the accuracy of one's financial information is not just a minor detail–it's pivotal. Regular checks, swift corrections, and awareness of what constitutes reliable information are essential steps in safeguarding one's financial future. In a world where numbers dictate opportunities, precision is paramount.

Consumer Privacy Concerns Explained

In today's interconnected world, the collection and use of personal information have become commonplace. Many individuals are unaware of how their information is gathered, utilized, and shared. The implications of this issue can be profound, particularly regarding financial well-being and individual rights. Privacy concerns arise when sensitive details are exploited without informed consent.

Organizations that collect personal information often engage in practices that may not prioritize individual privacy. This lack of transparency can lead to significant anxiety among people about their financial data and identity. Understanding these concerns is crucial for anyone navigating the financial landscape.

- Transparency is essential. Individuals must be aware of what information is collected.

- Consent is crucial. Users should give permission for their data to be shared.

- Security measures must be robust. Protecting personal information from breaches is vital.

- Awareness of rights can empower individuals. Knowledge can serve as a protective measure.

Many organizations may inadvertently contribute to the erosion of privacy by failing to disclose how personal information is shared. This lack of clarity fosters an environment where individuals feel vulnerable, often questioning who has access to their data and for what purposes. The ramifications can be far-reaching, affecting not only financial stability but also personal security and trust in the financial system. Thus, it is increasingly important for individuals to remain vigilant and informed about their own data.

Moreover, as technology advances, the methods of collecting and using personal information evolve. Traditional methods may no longer suffice in safeguarding privacy. With the rise of artificial intelligence and big data analytics, the potential for misuse has only increased. Thus, understanding the complexities surrounding financial information is essential for maintaining control over personal data.

To navigate these challenges, individuals should actively seek out transparent practices. Knowing where and how personal information is stored can help alleviate concerns. Additionally, engaging with organizations that prioritize privacy can ensure better protection of sensitive data.

Ultimately, it is not just about protecting financial details; it is about safeguarding one's identity and rights. The demand for ethical practices in the collection and use of personal information must grow, and consumers should advocate for their own privacy. By staying informed and proactive, individuals can defend their financial well-being in an increasingly complex environment.

How to Monitor Your Credit Report

Monitoring personal financial histories is essential for maintaining a healthy financial status. With the increasing reliance on electronic records, individuals must take an active role in understanding their financial profiles. Awareness and vigilance can prevent unexpected surprises. Typically, reports detail various aspects of one’s financial behavior and responsibility.

One effective strategy for oversight is to regularly obtain copies of financial histories from recognized agencies. Each individual is entitled to a free report once a year, ensuring that everyone has the opportunity to stay informed. This practice allows for identifying inaccuracies that could lead to negative assessments. It’s particularly important to scrutinize every entry.

Interestingly, most individuals overlook minor errors that might seem insignificant, but even a small discrepancy can carry weight. In a world where every point matters, a singular mistake could detract from what you have earned through diligent financial management. Therefore, making a habit of reviewing these statements can lead to informed decisions.

It’s wise to utilize various methods for tracking your financial profile. Utilizing online tools and applications that offer alerts and updates can streamline the process. Furthermore, many financial institutions provide resources that help in monitoring changes. This proactive approach can empower individuals to act quickly against fraud or misinformation.

| Action | Description |

|---|---|

| Request Free Reports | Obtain a free copy of your financial history once a year. |

| Set Alerts | Use financial tools to receive notifications of significant changes. |

| Review Regularly | Make it a practice to check your reports for errors. |

| Utilize Resources | Take advantage of offerings from financial institutions for monitoring. |

In the pursuit of safeguarding one’s financial wellbeing, taking these steps can build a strong foundation. The importance of remaining informed cannot be overstated. Not only does it highlight potential risks, but it also keeps individuals in control of their financial destinies.

How to Monitor Your Credit Report

Keeping an eye on your financial records is crucial for maintaining your economic health. Regular check-ups can unveil unexpected elements that may affect your financial standing. It’s essential to know what’s happening with your financial reputation. This not only empowers you but also helps in making informed decisions. Monitoring these reports offers insights into your financial behavior over time.

For starters, it's advisable to review your records at least once a year. This enables you to catch any discrepancies early on. Errors can happen, whether due to human mistakes or technical issues. When inaccuracies occur, they might lead to unfavorable outcomes. Therefore, identifying these problems promptly is vital.

Free services are available to help you keep tabs on your financial records. Many organizations provide annual complimentary reports, which help in understanding your financial footprint. Take advantage of these offers! They help ensure that you’re aware of any changes made in your profile. Additionally, some online platforms provide ongoing monitoring. This can alert you instantly to any alterations.

Another effective strategy is to set up alerts for significant changes. Notifications can help you stay informed about any activity that could influence your status. For example, if a new account appears or a payment is missed, you'll know immediately. This proactive approach allows you to address potential issues swiftly.

Moreover, it’s beneficial to familiarize yourself with the informational content within the report. Knowing what factors influence your financial reputation equips you to respond appropriately. Understand how various components, such as payment history and debt levels, interact. Such knowledge can lead to better financial practices over time. Engaging with these documents offers a significant advantage.

Lastly, don't hesitate to seek assistance from professionals if needed. Financial advisors can provide guidance tailored to your situation. This step can lead to improved management of your financial standing and goals. Remember, vigilance pays off; staying informed is an investment in your future.

Strategies for Improving Your Score

Improving your financial rating requires a multi-faceted approach. Various methods can lead to positive changes. Regularly examining your financial profile is crucial. Small adjustments can make a significant difference. But where to begin?

The initial step is to understand which elements influence your rating. Payment history holds substantial weight and should be prioritized. Ensure that bills are settled punctually to demonstrate reliability. If a payment was missed, rectify it as soon as possible; even a tiny lapse can adversely affect your standing, especially in competitive environments.

Next, reducing outstanding balances on outstanding obligations is essential. A lower credit utilization ratio can enhance your overall standing. Aim to keep this figure below 30% of your total limits. If possible, pay off debts entirely. However, don’t close old accounts, as this may shorten your credit history, which is often a significant factor.

Another effective tactic includes diversifying your financial commitments. Having a mix of different types of credit can positively influence your assessment. This could mean a combination of loans, credit lines, and revolving credit. A healthy balance showcases your ability to manage various forms of borrowing responsibly. Yet, be cautious–taking on unnecessary debt can be counterproductive.

Establishing a regular pattern of monitoring your report is vital. Keep an eye out for errors, as inaccuracies can lead to unfavorable outcomes. If discrepancies are found, dispute them promptly to ensure a fair evaluation. Many individuals remain oblivious to the potential pitfalls lurking within their reports, hindering their opportunities for improved ratings.

Lastly, patience is paramount. Elevating your status doesn't happen overnight. Consistency and diligence are key to achieving and maintaining your desired level. As you implement these approaches, remember that every small step brings you closer to your financial goals.

Strategies for Improving Your Score

Enhancing your financial standing can be a transformative journey. It involves more than just quick fixes; rather, it's about consistency and informed decisions. Understanding the underlying principles is crucial. Small, deliberate actions can yield significant results over time. Let’s explore effective techniques that can help elevate your financial stature.

- Pay bills on time.

- Keep credit utilization low.

- Review your reports regularly.

- Limit new credit inquiries.

- Maintain older credit accounts.

Timely payment of bills is one of the most fundamental strategies to adopt, as it demonstrates reliability to financial institutions, thus contributing positively to your overall standing. Additionally, keeping your utilization ratio below 30% allows you to exhibit responsible borrowing habits while creating a buffer that can protect your standing from fluctuations.

Regularly examining your financial statements is essential. This practice not only helps you identify errors but also provides insight into your spending behaviors. By being aware of what's happening with your finances, you can make proactive adjustments. Furthermore, minimizing the number of new inquiries made on your record can prevent unnecessary drops in your overall standing, as multiple requests in a short period often raise red flags.

- Develop a budget and stick to it.

- Consider automatic payments to avoid late fees.

- Utilize tools to track your expenses.

Establishing a budget serves as a roadmap for financial decisions, guiding your spending habits while fostering discipline over time. In addition, setting up automatic payments for recurring expenses can significantly reduce the chances of late fees, which can detrimentally affect your overall evaluation.

Older credit accounts should also be kept open, even if they're not in regular use, because the length of your financial history contributes positively to your overall picture. Each of these strategies will not only help in elevating your financial standing but also build a more secure future.

Lastly, always remember that the journey to improve your financial standing is a marathon, not a sprint. Consistency is key. With each positive action you take, you draw closer to achieving your desired financial goals.

The Future of Credit Scoring

As we navigate an increasingly complex financial landscape, the evaluation of financial reliability is undergoing significant transformation. New methodologies and emerging technologies are shaping this evolution. The emphasis is now on creating more holistic approaches to assessment. Within this context, identifying trustworthy sources of information becomes paramount.

Finding reputable outlets for obtaining financial assessments is crucial for individuals seeking to manage their financial health effectively. Not all sources provide the same level of reliability or accuracy. Some might even misrepresent information, leading to misguided decisions. Therefore, it's essential to differentiate between those that are reputable and those that are not.

| Criteria | Reputable Sources | Unreliable Sources |

|---|---|---|

| Transparency | Clearly outlines data collection methods | Vague about how information is gathered |

| Regulatory Compliance | Adheres to laws like FCRA | May operate outside of legal frameworks |

| Data Accuracy | Regularly updates and verifies information | Rarely checks for outdated or incorrect details |

| Customer Service | Accessible support for inquiries | Poor or nonexistent support options |

| Cost Transparency | Clearly quoted fees | Hidden charges or vague pricing structures |

When seeking financial evaluations, having a clear understanding of the available options is vital. A reliable source should offer comprehensive insights while safeguarding your personal information. Armed with the right tools, individuals can actively shape their financial futures. The market's evolution emphasizes the need for vigilance and discernment in choosing where to obtain essential evaluations.

In an era roaring with innovation, consumers must remain proactive. As new entities emerge, old practices may falter. Remaining informed about trustworthy options will arm you against misinformation. Ultimately, a wise choice can empower your financial journey, leading to informed decisions and better outcomes.

Identifying Reputable Data Sources

In a world overflowing with information, knowing where to find reliable resources is crucial. With numerous options available, distinguishing between trustworthy entities and those that may not hold up to scrutiny can be challenging. This section aims to guide you through recognizing credible sources.

First and foremost, look for transparency in operations. Reputable organizations openly share their methodologies and data collection practices. They should provide clear explanations about how they gather, analyze, and utilize the information. Additionally, it’s vital to check for accreditation and certifications.

- Seek sources with a strong industry reputation.

- Verify if they are members of professional associations.

- Look into customer reviews and testimonials.

- Assess their presence in established publications.

Furthermore, a trustworthy source will maintain compliance with relevant regulations. This adherence reflects their commitment to ethical practices and consumer protection. It’s also worth considering how long a company has been in operation. Longevity often indicates reliability; newer organizations may lack the track record to assure quality.

When evaluating potential options, don’t hesitate to ask questions. A reputable organization should readily provide information about its practices and policies. Prompt and thorough responses can be a good indicator of their professionalism. Conversely, vague or evasive answers might raise red flags.

- Check for industry recognition and awards.

- Investigate their partnerships with other established entities.

- Ensure they employ robust security measures to protect your information.

- Review their history of customer service and support.

Lastly, trust your instincts. If something feels off or too good to be true, it might warrant further scrutiny. Trust in your judgment, combined with diligent research, will lead you to reliable information sources capable of meeting your needs effectively. By following these guidelines, you can make informed choices that enhance your understanding and usage of available information.

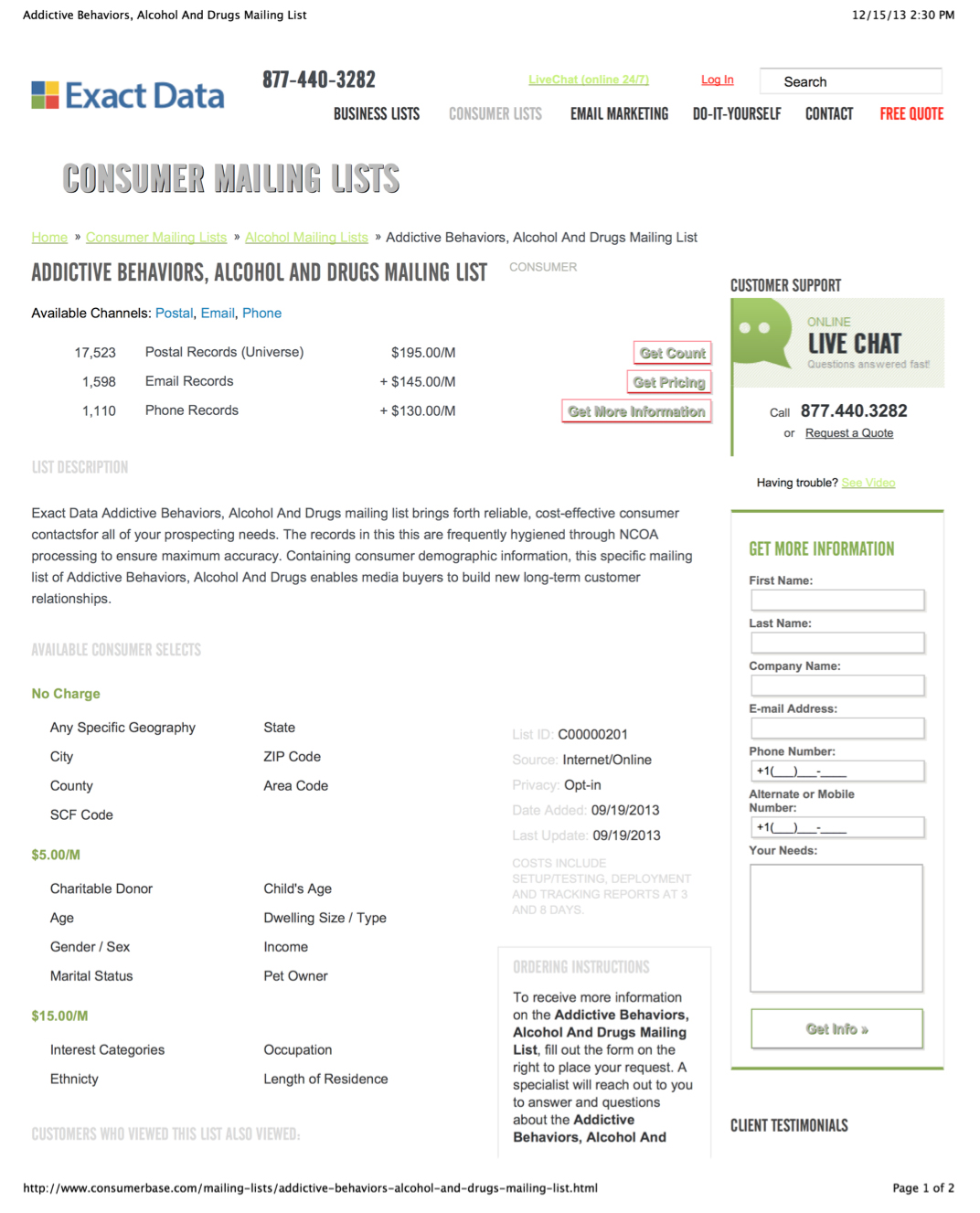

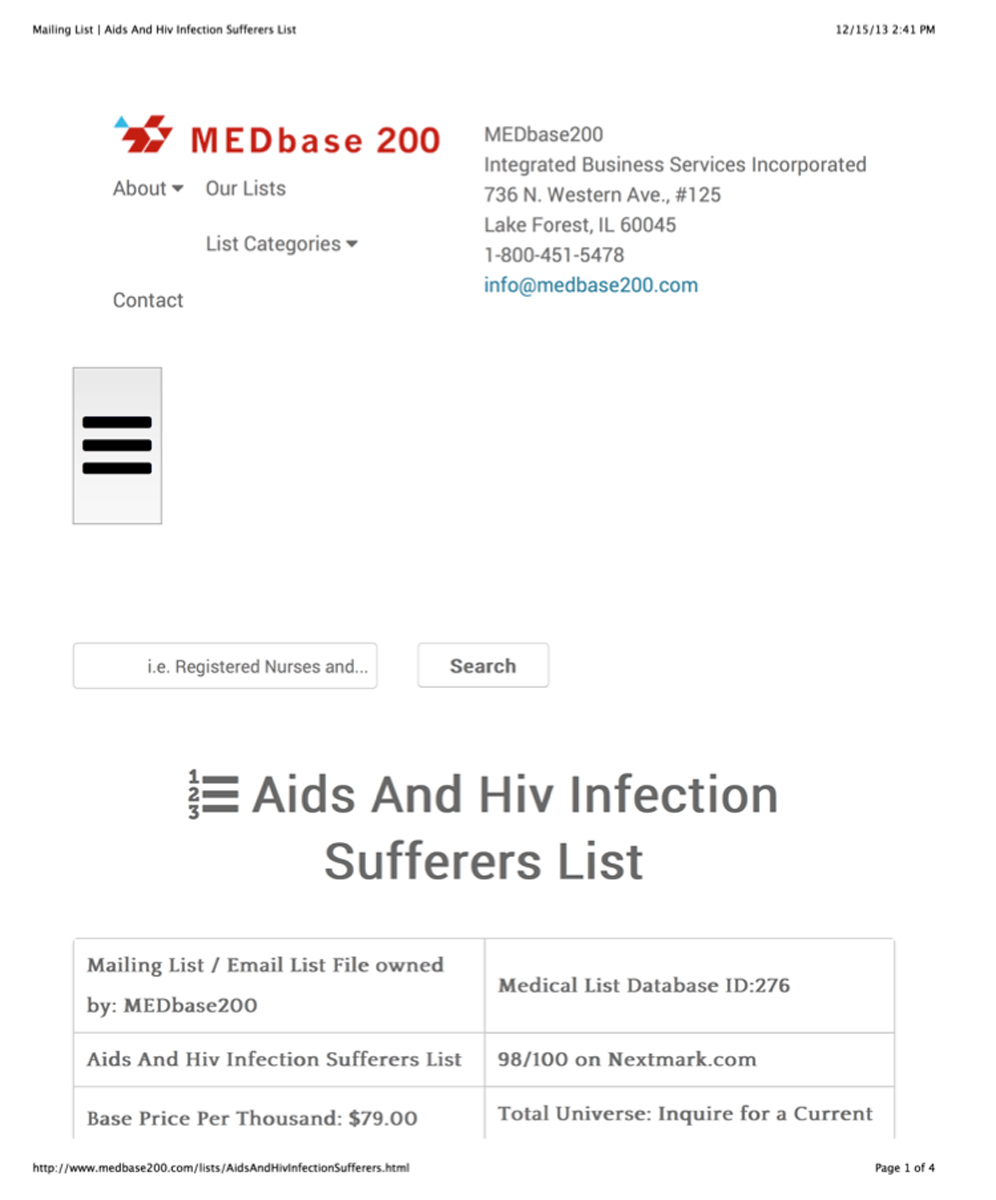

Risks of Buying Credit Reports

Purchasing credit evaluations can seem like a straightforward solution for monitoring personal financial standing. However, navigating this landscape is not without its pitfalls. Many individuals underestimate the potential challenges that come with acquiring such reports. Often, the allure of quick access to valuable information clouds judgment. This can lead to unwise decisions that may have lasting repercussions.

Here are some key risks associated with acquiring these evaluations:

- Inaccurate Information: Not all reports provide reliable insights. Mistakes can occur, leading to misleading assessments.

- Hidden Fees: Some sellers may have unexpected charges lurking in the fine print. It's crucial to remain vigilant about costs.

- Privacy Concerns: Sharing personal details can expose individuals to security risks. One must consider the ramifications of disclosing sensitive data.

- Scams: The market is rife with fraudulent entities claiming to offer legitimate reports. Always verify the credibility of the source.

- Limited Information: Some reports might not capture the full picture of your financial history, leaving gaps that can be misleading.

Individuals seeking to understand their financial situations better must exercise caution and conduct thorough research before making any purchases. When buying these evaluations, one might inadvertently open doors to various complications. For instance, opting for a cheaper report may result in receiving outdated or incomplete details, which could lead to poor financial decisions down the line. Ultimately, recognizing the potential threats linked to obtaining these documents can empower consumers to make informed choices.

In summary, while acquiring assessments can provide insights, it’s essential to approach with care. Understanding the risks is crucial. Consulting trustworthy sources and ensuring the authenticity of the report can mitigate dangers. An informed buyer is a safer buyer. Keep these points in mind to navigate this complex terrain effectively.

댓글목록

등록된 댓글이 없습니다.